aid

How to register for the Minha Casa Minha Vida Program

Minha Casa Minha Vida returned with several novelties after President Lula's return to power, in addition to more housing budget, families will have new advantages. Find out how to register here!

Advertisement

Conquer your house almost for free through Minha Casa Minha Vida

The Minha Casa Minha Vida housing program, which is usually the trademark of the current president, has returned with several novelties, and has exclusive advantages for those interested!

With it, thousands of Brazilians have access to quality housing and better living conditions, which provides more well-being to the neediest families.

The program has already helped thousands of Brazilians, and now has new updates after the return of President Lula!

Find out how to register throughout the text and check out the benefits of financing your property through Minha Casa Minha Vida!

How to register in Minha Casa Minha Vida?

First of all, it is important that you meet certain rules to be able to participate in the program, which will be described later in our content. For now, here's the step-by-step guide on how to register for the program:

- Firstly, your family must be in one of the program's income ranges, in which case go to a city hall in your city or to a Caixa Econômica Federal agency;

- Submit your identification documents, such as RG, CPF, among others;

- Take information and documents about the property you want to finance through Minha Casa Minha Vida;

- Afterwards, the bank will analyze the information for financing, such as installment values, property situation, among others;

- Finally, with the cadastral analysis completed, the bank should contact you to inform you whether or not you have been approved for financing the property, renovation or construction.

Rules for obtaining the Minha Casa Minha Vida benefit

The rules for monthly income bracket 1 (group that will most benefit from Minha Casa Minha Vida) are:

- Have gross monthly income of up to R$ 2,640;

- Not owning any house, apartment or real estate in general;

- Not receiving assistance benefits from housing programs, from other government instances (municipal, state or national).

Advantages of being part of the Minha Casa Minha Vida program

Being part of one of the largest housing programs in the world can bring you several advantages, some of which are:

- Exclusive financing conditions based on each participant's family income;

- Financing of housing in urban areas, whether new, used or for construction;

- Refurbishment or adaptation of properties for families with PWD members;

- Specialized services for each type of financing;

- CAIXA Keeping an Eye on Quality Program, to facilitate and mediate the relationship between builders and customers.

How to use FGTS in Minha Casa Minha Vida?

Did you know that it is also possible to use your FGTS to finance the property you want? The FGTS is a right of all workers under the CLT regime, whose objective is to protect the employee in cases, such as, for example, dismissal without just cause.

The FGTS brings several options for using the balance, one of which is the possibility of purchasing a property with the account value, however, you need to know how to use the benefit for this purpose.

The first step is to comply with the requirements of Caixa Econômica Federal. Are they:

- Have at least 36 months worked under the CLT regime receiving FGTS;

- Not having used the FGTS balance on another property or to deduct installments from another housing loan;

- Your name cannot be on the SFH (Housing Financial System) with an active financing agreement;

If you meet these requirements, you can choose one of the three ways to use the benefit. Are they:

- As a down payment to make the installments smaller by deducting a larger part of the financing;

- Amortize the installments or settle the final debtor balance to close the payments, or reduce the installments;

- Pay part of the installments by reducing the value of installments by up to 80% in up to 12 consecutive months, which can bring you immense financial relief.

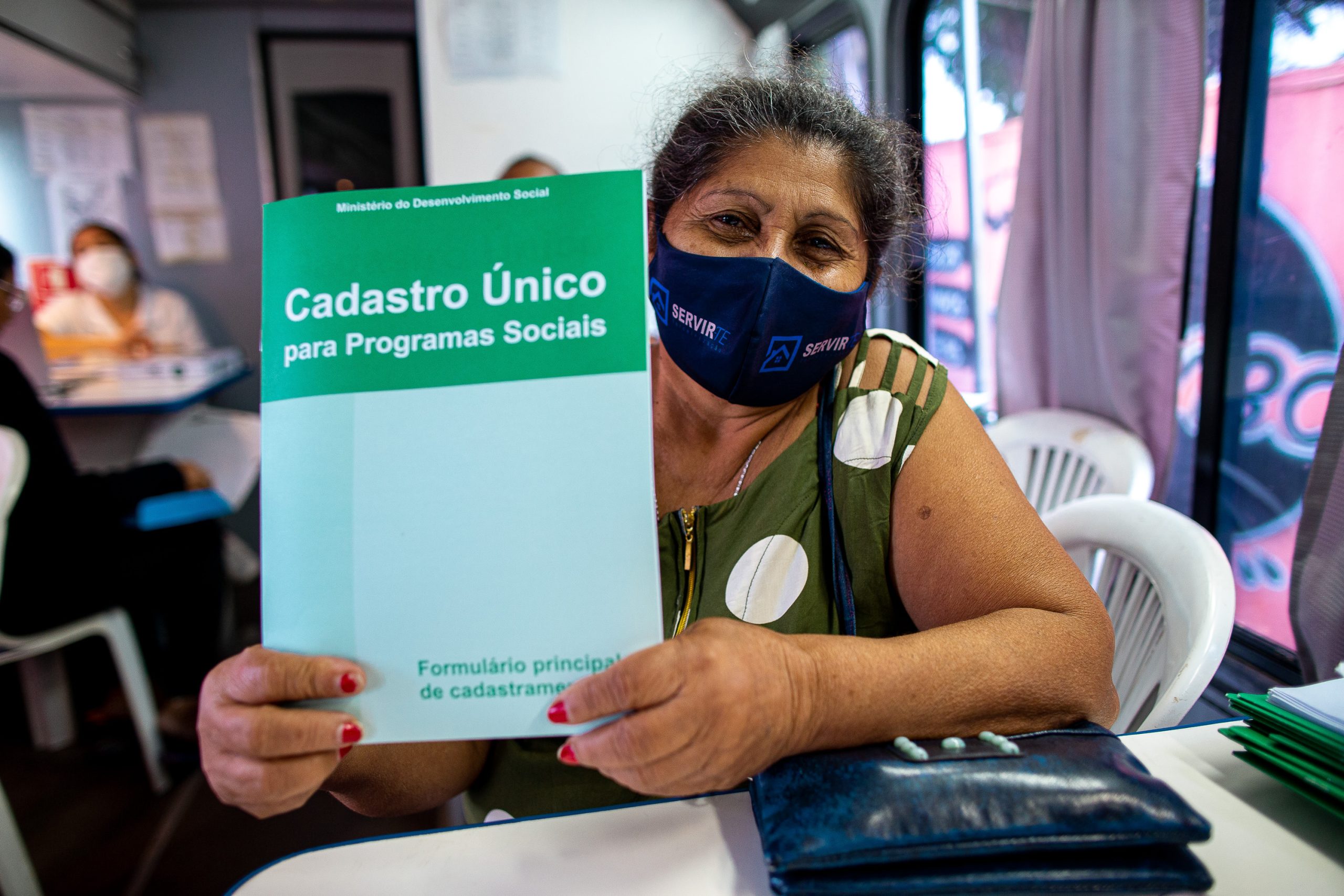

Sign up for the CadÚnico program!

Make your entry into the Minha Casa Minha Vida program easier by registering at CadÚnico! Find out here how the program can help you get a house faster!

Trending Topics

Find cheap flights and hotels with the SkyScanner app

Discover the best places in Brazil and the world by spending just R$59.99 on your ticket with SkyScanner! Find out how.

Keep Reading

How to buy cheap airfare? Trips from R$55.99

Find the best deals for your airline tickets! Buy your next ticket from R$55.99 and save!

Keep Reading

Capital One Venture Rewards Card: 2x more miles!

With the Capital One Venture Rewards credit card you can earn up to 10x more miles on your purchases!

Keep ReadingYou may also like

CVC ticket on sale from R$265 the way

Find promotional offers to travel to different destinations with CVC, which has promotions from R$265!

Keep Reading

JetSmart: discover South America!

With JetSmart you have flights to the main destinations in South America and you can also discover the most incredible landscapes!

Keep Reading

Wizz Air: exclusive tools to find the cheapest flight!

You can book hotels, rent cars or book a transfer to take you to your hotel. All this at an affordable price through Wizz Air!

Keep Reading