Tips

Chase Sapphire Preferred®: up to 60,000 bonus points!

Find out everything about one of the cards that offers the most advantages for you to travel, the Chase Sapphire Preferred®! The more you spend, the more benefits you get!

Advertisement

You have up to $ 200 from purchases at partner companies and can earn points by referring friends!

If you are used to traveling, whether for pleasure or work, the Chase Sapphire Preferred® credit card is an ideal choice.

This is due to its attractive points and bonus program, which gives you the opportunity to travel almost free of charge.

Now we're going to show you some relevant information about the card and everything you need to know before ordering your Chase Sapphire Preferred®.

- Annuity: The card has an annual fee of $95.

- Introductory bonus: You can earn 60,000 bonus points if you spend $ 4,000 on purchases in the first 3 months after account opening.

- Accepts negatives: The card is not approved for individuals with a negative credit history.

- Flag: The card operates on the Visa network.

- Roof: As a Visa card, it offers international coverage, allowing use in many countries and territories around the world.

- Other taxes: 21,49% 28,49% Variable APR.

- Main benefits: Earn 1x to 5x points per dollar spent with the card.

How does the Chase Sapphire Preferred® card work?

The Chase Sapphire Preferred® credit card is a premium card carrying the Visa brand, and incorporates all the advantages associated with that brand.

In fact, it also features an attractive points program in which every dollar spent on the card is equivalent to 1 point.

To make the offer even more attractive, when spending up to U$ 4,000 in the first 3 months, new customers receive a bonus of 60,000 points.

During your travels, the rewards continue to flow. By spending during these periods, you not only enjoy the benefits of the transaction but also gain additional perks.

Furthermore, the possibility of obtaining discounts at partner hotels and companies makes the experience even more advantageous. Over the course of your trip, every dollar spent becomes 2 points, which allows you to accumulate substantial rewards.

Key Features of the Chase Sapphire Preferred® Card

As with many cards, the Chase Sapphire Preferred® has some advantages and some disadvantages.

So, in addition to considering the annual fee, there are other aspects that deserve attention and may be less favorable during the card application process.

In order to assist in the analysis of factors that can influence the decision on whether it is a good choice, the pros and cons will be highlighted below.

Benefits

- Sign-up bonus: New account holders earn 60,000 Ultimate Rewards points after spending US$ 4,000 on purchases in the first three months of account opening.

- Point Earnings: The card offers Ultimate Rewards points in a variety of categories, including: 3x points on restaurants, 2x points on travel, and 1x points on general purchases.

- Access to the Chase Ultimate Rewards program: Ultimate Rewards points are versatile and can be transferred to over 100 travel partners, including airlines, hotels and car rental companies.

- Travel Benefits: The card offers a variety of travel benefits, including: trip cancellation insurance, trip delay insurance and lost baggage insurance.

- Purchase protection.

- Annual fee: The card's annual fee starts in the second year.

Disadvantages

- Annual fee: Although exempt in the first year, the card charges an annual fee from the second year onwards. If you don't spend enough to compensate, the card may not be the best option.

- Qualification Requirements: To be approved for the card, you need to have a good credit history and a minimum income of US$ 70,000.

- Redemption rules: The rules for redeeming Ultimate Rewards points can be a little complex. It's important to understand how points work before using them.

What benefits for frequent travelers does the Chase Sapphire Preferred® Card offer?

The Chase Sapphire Preferred® Card offers a variety of benefits for frequent travelers, including:

- Trip cancellation insurance

- Travel delay insurance

- Luggage loss insurance

- Purchase protection

So, in addition to these benefits, the card offers Ultimate Rewards points that you can transfer to over 100 travel partners, including airlines, hotels, and car rental companies.

Therefore, it can help you save money on your travels.

How do I apply for the Chase Sapphire Preferred® Card?

Requesting a credit card is common, so below you will see the best way to apply for the Chase Sapphire Preferred®, via the app or website.

From the site

First, go to the Chase website and search for the Sapphire Preferred® card. And then click to access the official page and start the request.

So, fill in the request details, and now just wait for the bank's response to find out if your request was approved.

Through the app

First, start by downloading the app. To do this, open the “App Store” or “Google Play Store” on your cell phone and search for “Chase” in the search field.

Then, click on the “Get” or “Download” button to download. You will need to enter your Apple ID password or use fingerprint authentication or Face ID to confirm.

But if you are using your Android device, Google Play Store will ask for some necessary permissions and you have to tap “Accept” to continue.

Finally, the Chase app will be downloaded and installed on your device. Then open the platform and go to the credit cards area, click on Chase Sapphire Preferred® and fill out the form.

So, just wait until you hear back whether your request has been approved.

The Platinum Card® American Express or Chase Sapphire Preferred® card: which is better for accumulating miles?

When deciding between The Platinum Card® and the Chase Sapphire Preferred® Card to increase your mileage, consider your travel needs and preferences.

In this sense, the two cards have exclusive advantages, but they differ in terms of benefits and characteristics.

For example, The Platinum Card® from American Express stands out for its prestige, offering access to VIP lounges, airline and hotel credits, as well as an extensive rewards program.

On the other hand, the Chase Sapphire Preferred® has a flexible Ultimate Rewards rewards program, making it possible to transfer points to travel partners.

For a better analysis of the distinctive features of each card and guidance on which might be the best choice for you, read our full article on The Platinum Card®.

Trending Topics

EasyFly: exclusive discounts for traveling around Colombia!

Discover how to fly to Colombia at the lowest prices! EasyFly helps you discover the charms of the country with low-cost tickets!

Continue lendo

Meet new people on #{city}. see how

In search of your better half? So start generating connections right now with one of the most famous dating apps, Tinder!

Continue lendo

Apps to weigh yourself without needing a scale!

With these scale apps you can weigh yourself, find out your BMI and even record your weight so you can monitor yourself during your diet!

Continue lendoYou may also like

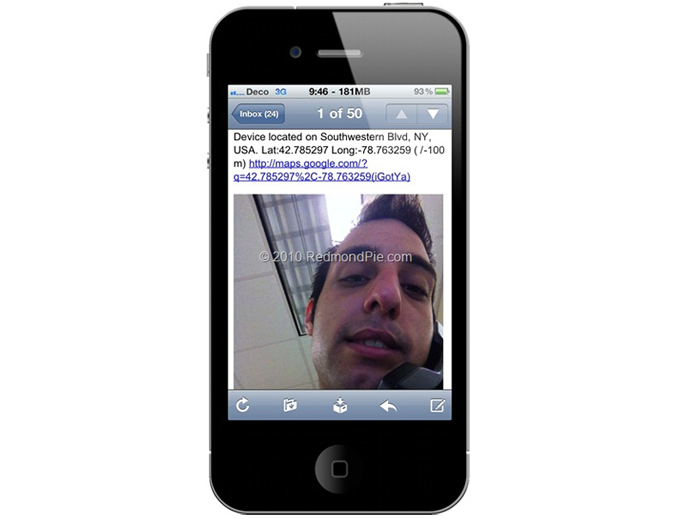

5 apps to take a picture of someone who made a mistake in their cell phone password!

Get to know 5 apps to take a photo of those who made a mistake in their cell phone password and have extra security when finding out who tries to invade your information!

Continue lendo

Earn at Least $19T25/hour with These Jobs at Mondelēz

Mondelez has job openings. Learn how to apply, check salaries and benefits. Start now!

Continue lendo

Most downloaded apps to follow football leagues!

See the best apps to follow the main football leagues and keep an eye on statistics, matches, results and much more!

Continue lendo